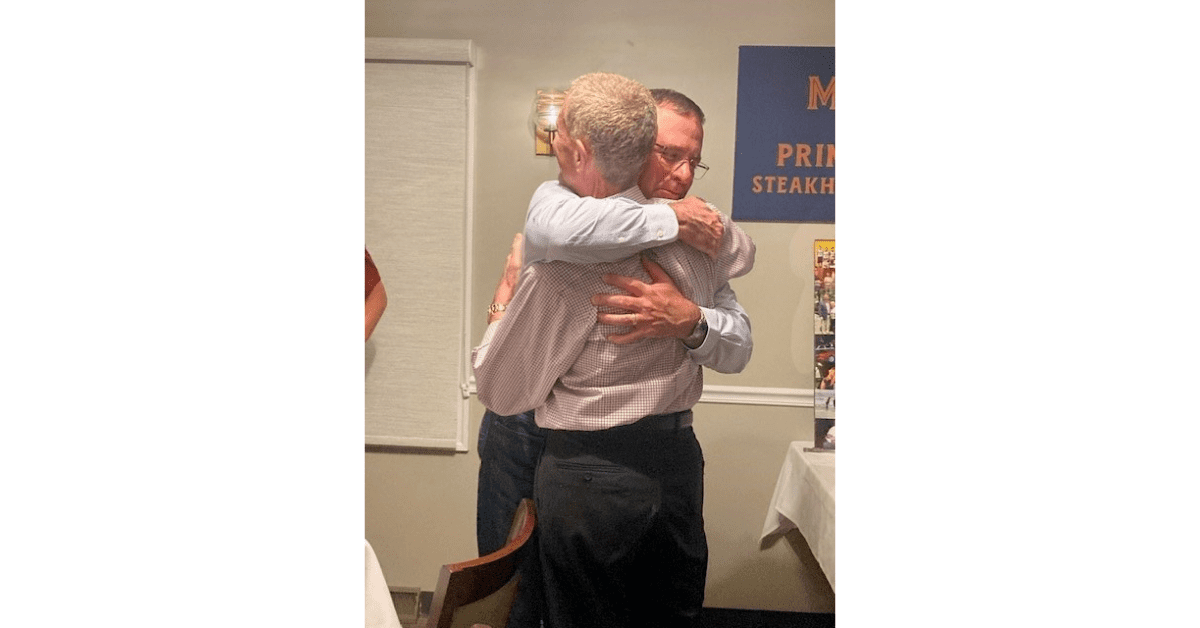

Photo: John Munie

This article is written in an “As Told To” format. John Munie is the founder and president of Focal Pointe, a $50 million firm specializing in commercial landscape maintenance, based in Caseyville, Illinois.

During the early years, I would look at the Top 100/150 lists and wonder what those guys knew that I didn’t. How did they find all those people to work? How did they sell so much work? Are they making money? How did they learn how to run such a big business?

Now that Focal Pointe passed the Top 100 threshold, and I can tell you that there’s no magic to it – just more zeros. As I look back, there are some things that never changed, and some things we do much better now. It’s more the lessons learned from 26 years in business than it is size.

When I started Focal Pointe in 1998, we did some things right. I was never confused about how to delight the customers or motivate the team around our ideas. The people side came easy for me and when you ache for the customers to be happy, you can’t help but do quality work. We would also do little things like lean the newspaper against the front door, pick up the dog toys, roll up the garden hose and take trash cans from the curb to the garage. I wanted the customer to know when they pulled into their driveway, we cared about them beyond the contract. That culture of service remains our foundation today.

What we weren’t so good at was the business side. For the first seven years, we were primarily a full-service residential company, and more expensive than others in the market, but we were also providing a superior level of service. I didn’t look at my company like an investor, I just wanted to delight the customers. Even though I have a degree in business administration, I didn’t have the business acumen I needed. Concepts yes, detailed financial controls for the green industry…not so much.

This was painfully clear in 2005. We were working on a large backyard project, that I didn’t know how to bid properly and didn’t have the necessary skill on the team to perform it. By August, I was in financial trouble. My bank didn’t want to loan me any more money and neither did any other local banks. My nerves were so bad, I was literally eating Pepto Bismol tablets for breakfast.

On Saturday of Labor Day weekend, I had two sales calls. On the second one, I knew if I didn’t sell this backyard water feature for $11,000 and get half down, I would not make payroll on Wednesday. I presented it to the customer, he asked if I needed any money down and I said half would be great. He wrote me a check for $5,500 and I made payroll on the following Wednesday by less than $100.

I survived payday, but I knew I wasn’t out of the woods, so I invited a customer to lunch who had grown into a friend. He was a successful businessman, and I thought he could give me some advice. He directed me to the president of a local bank that he knew was aggressively trying to grow their loan portfolio. With three years of financials in tow, I met with the president of the bank, told him my story, and he told me to come back the next day. He ended up giving me the loan that got me through the fall.

After several more years of struggles, including having to lay off employees during the 2008 recession, we had a good winter in 2010-2011, which allowed me to hire the guy I always paid extra to see at the NALP conferences – Kevin Kehoe.

He charged me $2,500 a day for two full days plus expenses, and that was a big leap for me. But for 14 years, I didn’t have any formal/proper budget process and was struggling to build something of value. Kevin taught me how to view the business as an investor and to consider what return I wanted to get on my assets. He taught me how to build the budget from the bottom up, set goals, job cost, structure my team for greater efficiency, and hold people accountable.

Our trajectory changed after that. The following year, we broke 10% net profit and our decisions as an organization just got better and better. I also started getting involved in peer groups which allowed me to benchmark all aspects of Focal Pointe’s performance, and that was like jet fuel for my competitive disposition. Each investment in education seemed expensive at the time, but it was always the cheapest money we spent.

I also have always been an avid reader of business books, and Jim Collins is one of my favorites. In his book ‘Good to Great’ he talks about how the great, enduring companies build their strategy around three basic things – What are we wildly passionate about? What can we be best in the world at? What can we make money doing? That really helped me simplify the game.

Once you’ve identified the one or two things those questions describe, I would then ask one more question: How do you personally define success? What are your dreams? If you’re not clear on your why, you’ll never have the fire in your belly to push through the hard times, and the advice you receive from a consultant, peer group, or mentor will be wasted.

Another lesson learned – I would caution against is using client feedback to dictate pricing. When a client or prospective client tells us they need to go a different direction due to price, I rarely believe that’s the real reason. It’s just the easiest reason for them to provide. Meaning, what buyer wants to invest the time it takes to work through the following explanation: ‘Well, we’re going a different direction because your communication was slow, your quality is so-so, the bid didn’t reflect what I asked, etc.’

That takes a lot more effort on the part of the buyer, and it also creates the possibility of a manager following up to address the complaints and try to save the deal. The easy button for all buyers is to say the price was too high. What I hear is ‘You failed to listen to our needs and demonstrate why you’re the best value.’ As a business owner, I would start there, but even now, we still experience that.

We have an outstanding maintenance sales team, but I used to hear from time to time that we were too high. Not too often anymore. I think they got tired of my response, which was: ‘If we’re too high, explain to me how we’re growing over 20% per year, and we retain 98%-101% of revenue each year when factoring in price increases?’ The fact is, we’re not too high for the right customers. We just have to work harder to prove that we’re providing the best value, so it puts extra burden on our sales team.

Another limiting factor for us when we were smaller was our ability to attract top talent. A small company is not in a position to pay top dollar, your benefits aren’t where you want them to be, and you’re not viewed as a strong, stable company. The one advantage we did have, and it did help us attract some good people, was the idea of building something from the ground up.

The key to becoming a destination employer is to be a place that people can be proud of when they tell others where they work. It all comes down to what I call the value equation and if you’re adding to the quality of the employee’s life. Compensation, benefits, respect, pride, growth, and meaningful work are all factors employees take into account. Like customers, it’s never one thing that drives satisfaction.

Looking back, if I can pin one thing that helped us go from $45,000 in 1998 to $50 million in 2024, it was a hunger for continuous improvement, and finding those mentors who could guide, encourage, and direct me along the way. Don’t be afraid to get advice. Find a mentor. Hire a consultant. Join a peer group. Get whatever education you can from NALP. If I had done that 10 years earlier, I’d be sharing our story at 42 years old instead of 52 – I would have gotten that time back.

By the way, remember that loan that helped me through the fall of 2005? A few years later, after paying it off, the president of the bank informed me that my friend/client who referred me to the bank was a better friend than I realized. He was an investor in the bank and knew the president well. After that first meeting at the bank, my friend called the president and pledged collateral for me. They probably wouldn’t have made the loan without it.

Regardless of your struggles or successes, recognize that if you operate with integrity, you’ll attract the right people into your world and they’ll move you forward more than you can anticipate. The cool thing about having others help you out of difficult times is the humility and gratitude you learn, and the more success you find the more it grows.

On my 50th birthday, I hosted a dinner in honor of those people, including the client who paid half-down for the water feature. I went around the room and told the story of how each of them changed my arc – it was one of the best nights of my life.

So, in that regard, perhaps I’m glad I didn’t learn the important business lessons 10 years earlier. My life is so much richer because of the endless gratitude I have and empathy for others as a result of those hard lessons.