Most landscape companies spend years fine-tuning their business before diving into M&As or attracting the attention of a private equity firm. In HeartLand’s case, acquisitions and private equity have been part of the business from the very beginning.

Founded in April 2016, Ed Schatz Jr., founder & CEO of HeartLand, partnered with Great Range Capital to establish the Kansas City, Missouri-based company with their first acquisition of Signature Landscape.

“Growth through acquisition provides the opportunity to gain scale quickly,” Schatz says. “In turn, increasing scale has given us the ability to invest in a wide range of support services for our operating companies. We’ve invested heavily in developing our people and business systems along the way. The sharing of best thinking across all of our HeartLand companies has proven to be another benefit of growing in this way.”

In 2019, Sterling Investment Partners acquired the company. Then, in December 2023, Sterling Investment Partners closed the sale of HeartLand to Pritzker Private Capital. Schatz says he doesn’t see these changes in capital partners as being sold though. He says they are periodic changes as part of continually evolving to facilitate growth.

“Different private equity groups have different capabilities and industry sectors on which they focus,” Schatz says. “They are also stratified to support certain size ranges of businesses according to where they are in their growth journey. For HeartLand, it’s always been about balancing the capabilities of our people, systems and capital structure to support robust growth.”

Since being acquired by Pritzker Private Capital, nothing has changed operationally. Schatz says they are directly involved with HeartLand’s leadership as partner in their growth planning and supporting various aspects of the business. He says their current scale and corresponding needs are quite different from a few years ago.

“They have strong support resources in financial and commercial aspects of business and we are able to tap into those to support HeartLand’s continued growth,” Schatz says. “We have been focused on learning together how to leverage PPC’s resources and our internal strengths for continued growth.”

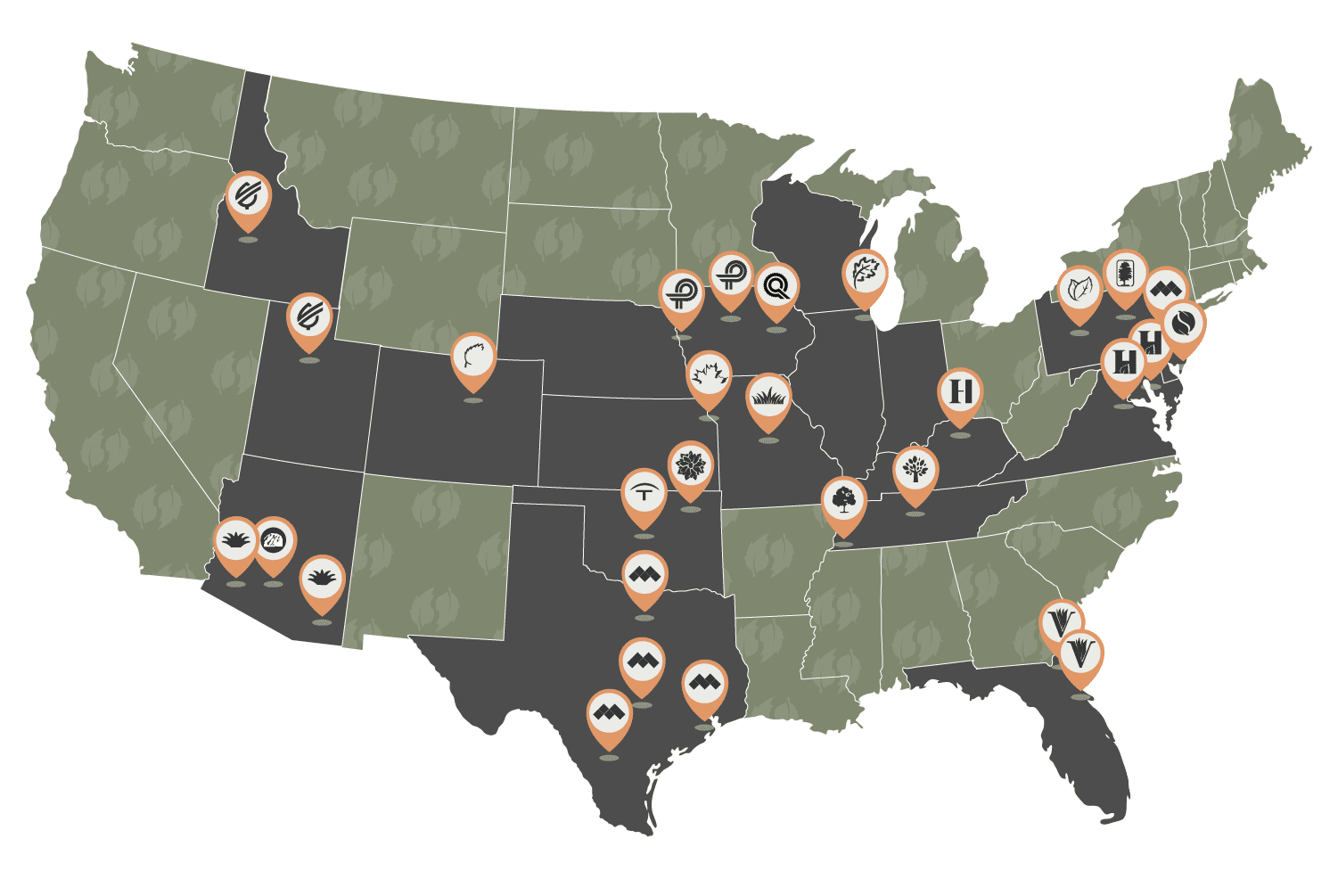

Currently, HeartLand has more than 4,500 employees working across 26 states. The company operates through 20 partner companies that are leaders in their respective markets, providing coast-to-coast commercial landscape maintenance year-round through 60+ branches to over 15,000 customers. In 2023, their annual revenue was $434 million.

While HeartLand doesn’t have a presence yet in regions like the West Coast or New England, Schatz says they go where opportunities present themselves.

“It just happens that we first planted our flag in the Midwest and we’ve spread outward from there,” Schatz says. “Every region has aspects of geography and economics that make them unique and we’ve found that diversification over time has strengthened HeartLand overall.”

Schatz says aside from the fundamentals of the business, including professional leadership, vibrant culture, service mix, client retention, consistent profitability, and safety record, HeartLand is focused on partnering with companies that have a strong foundation for growth that they can accelerate under their company umbrella.

HeartLand’s goal is to thoughtfully integrate local businesses into a larger enterprise and collaborate with these partners on the best thinking and training. Schatz says they help their partner companies become better versions of themselves and unlock their growth potential.

“Our primary focus has been on partnering with companies that are leaders in their regional markets, and therefore, they tend to be larger operations in most cases,” Schatz says. “There are instances, however, where it makes sense to add smaller businesses in selective markets where we can gain access to new market sectors and expand our service reach within a larger MSA.”

Their model allows the opportunity for an operating company to maintain its legacy brand while being a part of the larger organization. Schatz says because they are so focused on cultural fit and organizational alignment with prospect companies their retention of employees and clients has been extremely strong.

“Our ‘People First’ approach runs through everything we do,” Schatz says. “In addition to providing competitive pay, good benefits and the opportunities that growth brings, HeartLand’s focus on training and development of employees at all levels sets us apart. We hear over and over again from employees how important that is to them; we’ve listened and built exceptional programs to meet their needs and improve client service.”

Schatz says each acquisition has unique reasons for selling. Some of the owners remain on in operational leadership roles post-closing while others have transitioned to strategic advisory roles.

“Culturally, the companies with which we partner share core values that are aligned with ours,” Schatz says. “At the same time, each operating company within our portfolio possesses qualities that have made them market leaders. We place great value on that and work hard to protect their unique brand names and local DNA, while enhancing their brand presence through elevated marketing efforts.”

HeartLand is more focused on the quality of their acquisitions, rather than the quantity. They average about four acquisitions annually. Schatz says the size and thoughtful integration requirements govern their pace. With rumors of a recession, he says they are well-positioned for navigating normal business cycles and will continue to acquire businesses when it makes good economic and business sense for them.

The company has a four-person M&A team that knows what to look for and speaks the language of potential partner companies.

“As with other aspects of business, M&A is built upon strong relationships,” Schatz says. “Opportunities come to us in various ways, sometimes through investment bankers, occasionally through direct outreach and often through referrals by former owners of companies that have partnered with HeartLand.”

Schatz says the key to successfully growing through M&A is to develop a clear and thoughtful strategy and stick to it.

“Companies without a clear strategy or those who acquire just to grow their top line to achieve short-term goals are often unsuccessful,” Schatz says. “We are capable of adapting and enhancing our strategy as we grow, but we always work within our strategic framework to ensure success.”

This article was published in the May/June issue of the magazine. To read more stories from The Edge magazine, click here to subscribe to the digital edition.