Sponsored Content

Congratulations on starting your own landscaping business! Whether you run a small business with employees or are simply paying yourself, you’ll find that payroll is not only an essential part of your operations, but it is also legally required. New to the process? Don’t worry! This small business payroll checklist explains what you need to do to set everything up.

1. Consider the rules for your business structure

First things first, your business structure helps determine your payroll structure. The payroll rules depend on what type of entity you’ve used for small business, as well as who is working for you:

Sole proprietorship – This is the most straightforward type of business structure, where you are the only owner. If you are also the only one working for your small business, you won’t need to set up payroll. Any business income passes directly to you for your individual tax return. However, if you start hiring other employees, you’ll need a payroll system.

Partnerships – Partnerships have more than one owner. Each partner receives their percentage share of business income directly and then handles the tax work themselves, the same as a sole proprietorship. You only need to set up payroll if you hire employees who are not partner owners.

Corporations – Whether you set up a C-Corporation or an S-Corporation, you will need to set up a payroll system. This is true even if the owners are the only ones collecting a salary.

LLC – With an LLC, you choose how to operate tax-wise: as a corporation, as a sole proprietorship for one owner or as a partnership with multiple owners. The payroll rules will match whichever system you decide on. Once again, if you hire non-owner employees, you’ll need a payroll system regardless of which you pick.

2. Register for an EIN

A lot of small business owners register for an Employer Identification Number (EIN) at the start but in case you haven’t, you’ll need to get one to allow you to submit payroll taxes to the IRS. Don’t worry – it’s easy! An EIN is a federal tax identification number for businesses. If your small business is a partnership, a C-Corp or an LLC that elected one of these systems, you should have received an EIN when you set up your business. If you have a sole proprietorship, an S-Corp or an LLC operating as a sole proprietorship, you’ll need to apply for an EIN through the IRS website or by mailing in Form SS-4, Application for Employer Identification Number.

If your state government also charges income tax, you should check with their department of revenue to see what process they use. Some of them will let you use your federal EIN to submit payroll taxes. Others will require you to apply for a separate state ID number.

3. Collect required employee documents

When you bring on a new employee, they will need to fill out a few documents for your small business payroll system:

Form I-9, Employment Eligibility Verification – This verifies the identity of an employee and confirms they can legally work in the United States.

Form W-4, Employee’s Withholding Certificate – An employee uses this form to set their tax withholding: the amount your payroll system needs to hold back from each paycheck to cover their estimated taxes for the year.

State Withholding Certificates – If your state charges income tax, your employee will need to submit a separate form for their state income tax withholding too. You can get these forms from your state’s revenue department.

Note that if you hire independent contractors who aren’t employees, they won’t be on your payroll. You will need to have them submit a W-9 form with their SSN or company EIN. That way you can report what you paid them to the IRS. However, you won’t need to handle their tax withholding or put them on your small business payroll system.

4. Decide on your payment period

Next on your payroll checklist, you should decide how often you’d like to pay your employees: weekly, biweekly, semi-monthly, or monthly. Less frequent payments reduce your payroll work and costs, but employees generally prefer earlier access to their money. For employees with lower wages or those who work by the hour, it tends to make sense for more frequent pay periods, especially if you need to track overtime. For higher-paid salaried workers, they might be ok with monthly.

5. Plan employee benefits

You should also decide whether you will offer any benefits that employees will pay for or contribute to from their paychecks. Some of the benefits that could impact your payroll calculation include:

- Health insurance

- Group life and disability insurance

- 401(k)s and other workplace retirement plans

- Dental

- Job expenses (if you charge employees for meals, uniforms, etc.)

6. Calculate payroll for each employee

Figuring out what to actually pay each employee is a three-step calculation. Let’s dive in:

6a) Start with their gross pay

This is the amount they earned pre-tax during the pay period. It’s their salary for salaried workers. For hourly workers, multiply the number of hours they worked by their pay rate. Make sure to account for any overtime with hourly workers, which pays time and a half their hourly wage.

6b) Withhold the necessary taxes and other deductions

For each employee, you should withhold the amount necessary to meet their federal, state, and local income taxes as well as what they owe for Medicare and Social Security. You should also make any necessary deductions for employee benefits like insurance, retirement plans, and job expenses.

As the employer, you will need to pay your own share of taxes for each employee’s Medicare and Social Security. In addition, you would need to calculate and pay federal unemployment (FUTA) yourself; none of this comes from the employee’s paycheck. If you need help figuring out the withholding, a payroll app like Roll by ADP can run the numbers for you while providing other useful payroll tools to solve common challenges.

6c) Determine the net pay

Once you make these adjustments, whatever is left over is your employee’s net pay. This is what you will need to give them. Depending on your state, you may also be required to put together a statement showing what you withheld for everything.

7. Pay employees as scheduled

Next, figure out how you would like to give employees their net pay. Direct deposit can be a fast and inexpensive option. You could also offer your employees paycards, a type of debit card where you load up their wages. Paper checks are another option, but they are more time – consuming and expensive for you to prepare and for your employees to cash. Whichever you choose, pay your employees according to your schedule.

8. Store employee payroll taxes

You need to submit federal taxes from your employees once every quarter. Until then, you should keep the money in a safe place. For easier recordkeeping and to avoid accidentally spending employee taxes, strongly consider opening a separate bank account only for collecting and then submitting these taxes.

9. Submit taxes by the government deadlines

Every quarter, you will need to submit IRS Form 941, Employer’s Quarterly Federal Tax Return. You will also need to submit the collected taxes through the IRS Electronic Federal Tax Payment System® (EFTPS). Once a year, you will also need to submit Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return. Last, you need to follow the deadlines and payment process for your state and local income tax departments (if applicable.)

10. Update the system as needed

Each time you bring on a new employee, you’ll need to upload them into your small business payroll system and set their tax withholding. Your current employees may also request to change their withholding and benefits in the future. You would need to handle these payroll updates well.

11. Store relevant payroll records

The last step of the payroll checklist is to make sure you maintain accurate records. That way you can verify in case an employee thinks there’s a mistake or you face a government audit. Documents and records to hold onto include:

- Each employee’s name, occupation, and SSN

- The numbers setting an employee’s pay (hours worked, pay rate, any overtime, etc.)

- Payroll deductions

- When you made each payment and the taxes withheld

- Each employee’s W4

Generally, you should hold onto these records for at least four years.

12. Use payroll software for help

If managing payroll manually feels like a lot of work, that’s because it quickly can be. You could hire an accountant or bookkeeper for this role, but it can be costly. The good news is there’s new technology available to make this easier.

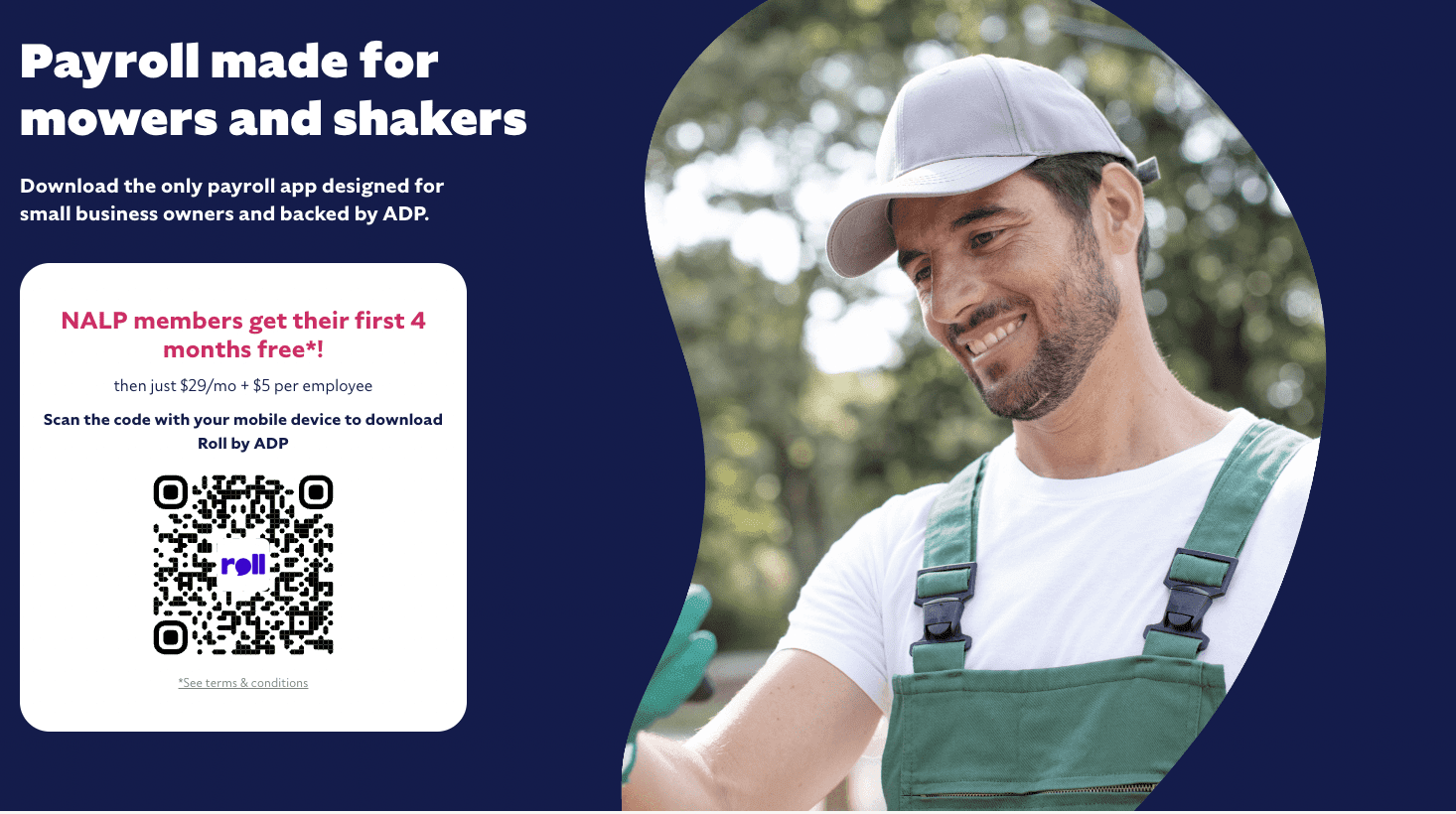

Roll by ADP is an efficient and cost-effective option for small businesses. Roll provides unlimited payroll runs with next-day direct deposit and available instant transfers for full-time and part-time workers, including W-2 and 1099 contractors across all 50 states. It even automatically calculates, withholds, and files federal and local taxes. And it’s backed by ADP, guaranteeing industry-leading security and reliability. Clover customers get their first 4 months free*, then pay just $29 per month, plus $5 per employee. For more information on running payroll and your small business, check out the Roll by ADP blog. We are now offering NALP members 4 months free* of payroll.